We began reducing our weight in banks a month ago and continued further last week and today. The fund’s current weight in Financials is 12.9%. This compares to an index weight of 16.9%.

Within Financials we do not own any insurance companies. Our Financials holdings are all European banks. The Banks and Capital Markets weight of the benchmark is just over 10%. We have added to Healthcare and Telecoms with the proceeds and topped up Carrefour and Shell.

The problems in the US banking sector do not apply to Europe today, but there are lessons for Europe down the line that have implications for earnings. European banks have also rallied 45% in the past four months and 110% since November 2020, and so a pullback is understandable.

In our process we seek two overarching elements in our investments: low valuations and positive operational momentum.

European bank valuations remain low but the runway for their positive earnings momentum is shortening. We still see banks beating earnings expectations in the coming quarter or two, but we see lower likelihood of earnings beats beyond that period for some companies. Valuations are low and capital returns are high, and we still expect the right banks to perform well compared to the index in the coming months. But there is a decent case to lower the weight and so we have done so.

By now you are all familiar with the peculiarities of Silicon Valley Bank (SVB). It had a very weak deposit franchise and was highly vulnerable. Similar small US banks with Venture Capital and Tech franchises remain vulnerable in the coming weeks. Whilst this is not a systemic event, there are important lessons that have implications for US bank earnings immediately and for European bank earnings in the future.

Competition for capital

The major read-across to other US banks is that deposit competition is heating up. The competition for capital is rising. If you can generate high returns investing risk-free in US Treasuries, this puts pressure on low yielding bank deposits. Those banks that do not have strong retail deposit franchises are having to pay up for deposits or lose them. The technical term for the relationship between deposit pricing and interest rates is “deposit beta”. US deposit beta was already rising before this recent crisis. The events of the last week will lift deposit beta more sharply, and probably closer to one – in other words, rate hikes will be matched by deposit hikes. This means US bank net interest margins have peaked for the time being. Against a backdrop of low loan growth and no margin expansion, it will be hard for US banks to grow earnings in a way that beats expectations.

Markets have made two large adjustments in recent days. For small US banks with fragile deposits, investors have sharply marked down share prices due to bank-run risk. For large banks where bank-runs are not likely, investors are pricing in peak margins and therefore peak earnings.

In Europe, deposit beta remains low for now. The competition for capital is not as intense. The alternative to bank deposits is short-dated bond yields offering 2.5% – 3%. Whilst this is quite attractive, it is not as compelling as US rates at 4.5% and higher. European banks are also helped by a system-wide loan-to-deposit ratio that is below 100%. There has not been much evidence of European deposits moving out of the banking system into money market funds as yet. Most European banks have solid retail deposit franchises that are sticky.

That being said, if European interest rates were to move higher and get closer to 4%, the competition for capital would become more intense in Europe, like it is in the US now. Banks would then compete for deposits by offering higher rates and this would impact net interest margins. In neither the US nor Europe is this problem systemic. This is a question about margins more than anything else. System wide, the US and European banking systems can maintain a healthy level of deposits if they pay a bit more for them. But paying more for deposits means profitability is reduced and so the earnings momentum of the sector fades.

Why some banks are still worth owning

Given this backdrop, why still own any banks? In Europe the runway for earnings growth is shortening but there is still some distance left. Valuations are low and dividends and buybacks are high. The shareholder yield from dividends and buybacks is close to the best in the market. Only oil companies are better. We also see the lending standards of the last decade being solid and so we expect loan loss provisions to be contained, even in a more difficult macro environment. The sector trades below book value, with PE ratios of 7-8x and dividends of 6% with buy-backs on top.

In terms of loan category exposures, we have become more selective. We have reduced our exposure to banks with large Commercial Real Estate (CRE) franchises. For most banks, loan-to-value ratios in CRE are only 50% and so large price declines can still be absorbed in the event of a default with limited difficulty. Given this, we do not see CRE stress creating a systemic event for European banks, but we anticipate the volume of CRE defaults to rise in the coming months and this to be a source of disruption that we want to avoid.

We also prefer banks with smaller franchises in mortgage lending. Whilst we do not anticipate a significant pick-up in mortgage-related defaults, we do expect house prices to fall in most regions of northern Europe. Unlike in the US, it is difficult to walk away from a mortgage in Europe and so we expect continued payments and low loan-losses. But the prospect of negative equity is real for recent entrants into the housing market and this may cause some disruption to the most overvalued housing markets. Risks are lower where housing valuations are lower.

We prefer high quality corporate lending over real estate-based exposure. Dislocation in the bond market has the potential to drive solid increases in profitability for corporate lending.

Impact of contracting liquidity and high interest rates

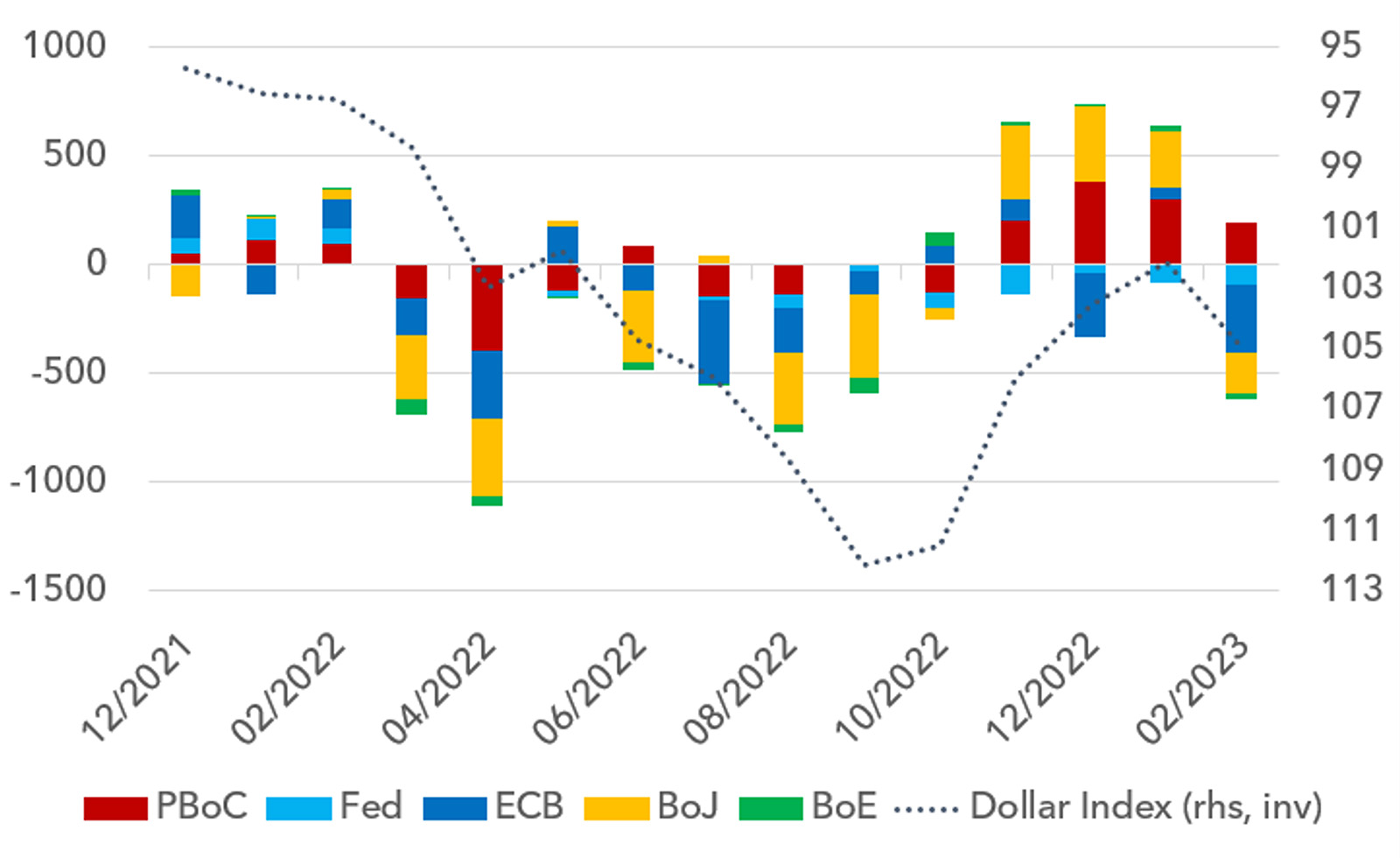

Leaving the banks to one side, there may be a wider message about this sell-off. As you know, we have been concerned about the combination of rising rates and contracting liquidity. These two elements in combination are not constructive for asset prices. We wrote recently about central bank liquidity. Whilst the Bank of Japan has not changed tack yet, the rising dollar drove a contraction in US dollar denominated liquidity in February. Whilst it is very difficult to predict currency moves, we know that if the dollar were to continue to rise, liquidity will contract faster. Falling liquidity coupled with high rates may cause asset prices to fall.

Below we show an updated chart showing aggregate central bank balance sheets in dollars, including February’s data. We overlay the data with the Dollar Index inverted.

Monthly Change in Central Bank Balance Sheets, $bn vs Dollar Index (inverted)

Recent days have increased the evidence that competition for capital is becoming more intense. We believe the best companies to cope with this backdrop are those with high free cash flow yields and strong balance sheets. It is possible for certain banks to profit from this environment and so there is still a case to own some. Bigger picture, low valuations should continue to be a critical defence in what appears to be a more hostile investing backdrop. We believe the Lightman European Funds can continue to generate positive absolute and relative returns in 2023, as they were able to in 2022.

Sources:

The Federal Reserve, the Bank of Japan, the European Central Bank, the People’s Bank of China, the Bank of England, Bloomberg, Lightman Investment Management.

Legal

Disclaimer

This communication and its content are owned by Lightman Investment Management Limited (“Lightman”, “we”, “us”). Lightman Investment Management Limited (FRN: 827120) is authorised and regulated by the Financial Conduct Authority (“FCA”) as a UK MiFID portfolio manager eligible to deal with professional clients and eligible counterparties in the UK. Lightman is registered with Companies House in England and Wales under the registration number 11647387, having its registered office at c/o Buzzacott LLP, 130 Wood Street, London, United Kingdom, EC2V 6DL.

Target audience

This communication is intended for ‘Eligible Counterparties’ and ‘Professional’ clients only, as described under the UK Financial Services and Markets Act 2000 (“FSMA”) (and any amendments to it). It is not intended for ‘Retail’ clients and Lightman does not have permission to provide investment services to retail clients. Generally, marketing communications are only intended for ‘Eligible Counterparties’ and ‘Professional’ clients in the UK, unless they are being used for purposes other than marketing, such as regulations and compliance etc. The Firm may produce marketing or communication documents for selected investor types in non UK jurisdictions. Such documents would clearly state the target audience and target jurisdiction.

Collective Investment Scheme(s)

The collective investment scheme(s) – WS Lightman Investment Funds (PRN: 838695) (“UK OEIC”, “UK umbrella”), and WS Lightman European Fund (PRN: 838696) (“UK sub-fund”, “UK product”) are regulated collective scheme(s), authorised and regulated by the FCA. In accordance with Section 238 of FSMA, such schemes can be marketed to the UK general public. Lightman, however, does not intend to receive subscription or redemption orders from retail clients and accordingly such retail clients should either contact their investment adviser or the Management Company Waystone Management (UK) Limited (“Waystone UK”) in relation to any fund documents.

The collective investment scheme(s) - Elevation Fund SICAV (Code: O00012482) (“Luxembourg SICAV”, “Luxembourg umbrella”), and Lightman European Equities Fund (Code: O00012482_00000002) (“Luxembourg sub-fund”, “Lux product”) are regulated undertakings for collective investments in transferrable securities (UCITS), authorised and regulated by the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg. In accordance with regulatory approvals obtained under the requirements of the Law of 17 December 2010 relating to undertakings for collective investment, the schemes can be marketed to the public in Luxembourg, Norway, Spain, and Republic of Ireland. Lightman, however, does not intend to receive subscription or redemption orders from any client types for the Lux product and accordingly such client should either contact a domestic distributor, domestic investment advisor or the Management Company Link Fund Solutions (Luxembourg) S.A. (“Link Luxembourg”) in relation to any fund documents.

Luxembourg umbrella and Luxembourg sub-fund are also approved for marketing to professional clients and eligible counterparties in the UK under the UK National Private Placement Regime (NPPR). UK registration numbers for the funds are as follows: Elevation Fund SICAV (PRN: 957838) and Lightman European Equities Fund (PRN: 957839). Please write to us at compliance@lightmanfunds.com for proof of UK registration of the funds.

Luxembourg sub-fund is also approved for marketing to qualified investors in Switzerland, within the meaning of Art. 10 para. 3 and 3ter CISA. In Switzerland, the representative is Acolin Fund Services AG, Leutschenbachstrasse 50, 8050 Zurich, Switzerland, whilst the paying agent is NPB Neue Privat Bank AG, Limmatquai 1 / am Bellevue, 8024 Zurich, Switzerland.

Accuracy and correctness of information

Lightman takes all reasonable steps to ensure the accuracy and completeness of its communications; we however request all recipients to contact us directly for the latest information and documents as issued documents may not be fully updated. We cannot accept any liability arising from loss or damage from the use of this communication.

Wherever our communications refer to a third party such as Waystone, Link, Northern Trust etc., we cannot accept any responsibility for the availability of their services or the accuracy and correctness of their content. We urge users to contact the third party for any query related to their services.

Important information for non-UK persons (Including US persons)

This communication is not intended for any person outside of the UK, Switzerland, or the European Economic Area (EEA). Lightman or any of the funds referenced in this communication are not approved for marketing outside of the UK, Switzerland, or the EEA. All such persons must consult their domestic lawyers in relation to services or products offered by Lightman.

Risk warning to all investors

The value of investments in any financial assets may fall as well as rise. Investors may not get back the amount they originally invested. Past performance is not an indicator of future performance. Potential investors should not use this communication as the basis of an investment decision. Decisions to invest in any fund should be taken only on the basis of information available in the latest fund documents. Potential investors should carefully consider the risks described in those documents and, if required, consult a financial adviser before deciding to invest.

Offer, advice, or recommendation

No information in this communication is intended to act as an offer, investment advice or recommendation to buy or sell a product or to engage in investment services or activities. You must consult your investment adviser or a lawyer before engaging in any investment service or product.

GDPR

Lightman may process personal information of persons using this communication. Please read our privacy policy.

Copyright

This communication cannot be distributed or reproduced without our consent.